Understanding What African Tech Investors Want

The African tech scene, particularly in Nigeria, has witnessed an infusion of over $967 million in investments, showing that we have a thriving tech ecosystem that captures both local and international attention. However, how can early-stage startups reach their funding potential and improve these numbers?

In this ecosystem, innovation works with opportunity, and understanding what entices investors is critical for startups seeking funding.

Key Criteria for African Tech Investors:

1. Market Potential and Growth Trajectory: Investors are keen on startups that operate in sectors with substantial growth potential. A clear market strategy and a trajectory for sustainable growth is a magnet for investment.

2. Innovation and Technology: The core part of any tech investment is innovation. Investors seek startups that bring solutions to existing problems or disrupt industries through technological advancements. A strong foundation in tech is a non-negotiable criterion.

3. Traction and User Engagement: A startup's ability to attract and retain users is a very important when pitching for/seeking investment. Investors look for traction indicators, such as user numbers, engagement rates, and feedback, to gauge the market's acceptance of the product or service.

4. Experienced and Committed Team: The team behind a startup is as important as the idea and solution it is seeking to bring. Investors seek founders and teams with a proven track record, domain expertise, and a relentless commitment to the startup’s success.

5. Scalability: Investors are drawn to startups with the potential for scalability. A business model that can easily expand to new markets or accommodate a growing user base is very attractive.

6. Clear Revenue Model: Articulating a clear path to profitability is important. Investors want to see a robust revenue model and a realistic plan for monetization that ensures a sustainable, profitable future for the startup.

Successful Funding Stories in African Tech, 2023:

1. Flutterwave: In 2023, this FinTech giant secured a remarkable $250 million in a single funding round. Fintech companies secured eight spots among the top twenty top-funded African startups in 2023, according to Empower Africa.

2. Moove: In 2023, Moove had two successful funding rounds. First, it secured $8 million for expansion into Ghana. Subsequently, it raised $76 million to strengthen its position in the global market.

3. Planet42: This South Africa-based startup secured $100 million raise in funding in February, 2023 to scale operations across South Africa and Mexico.

4. Sabi: Based in Nigeria, Sabi successfully secured $38 million in Series B funding in May to advance its technological infrastructure.

4. Husk Power Systems: This cleantech startup based in Africa and Asia raised $103 million in its Series D funding round in October, 2023. The funding was to drive rural electrification efforts and extend the reach of renewable energy services in both Africa and Asia.

5. Nuru: In July, 2023, Nuru secured $40 million in a Series B funding round to build sub-Saharan Africa's largest mini-grid

These success stories show that diverse sectors can attract investment in African tech. However, only startups addressing fundamental challenges with innovative solutions catch the attention of investors. What insights and criteria do you have on African tech startups securing funding? What are your predictions for funding rounds in 2024?

Share with me in the comments or via email at victoria@devcenter.co.

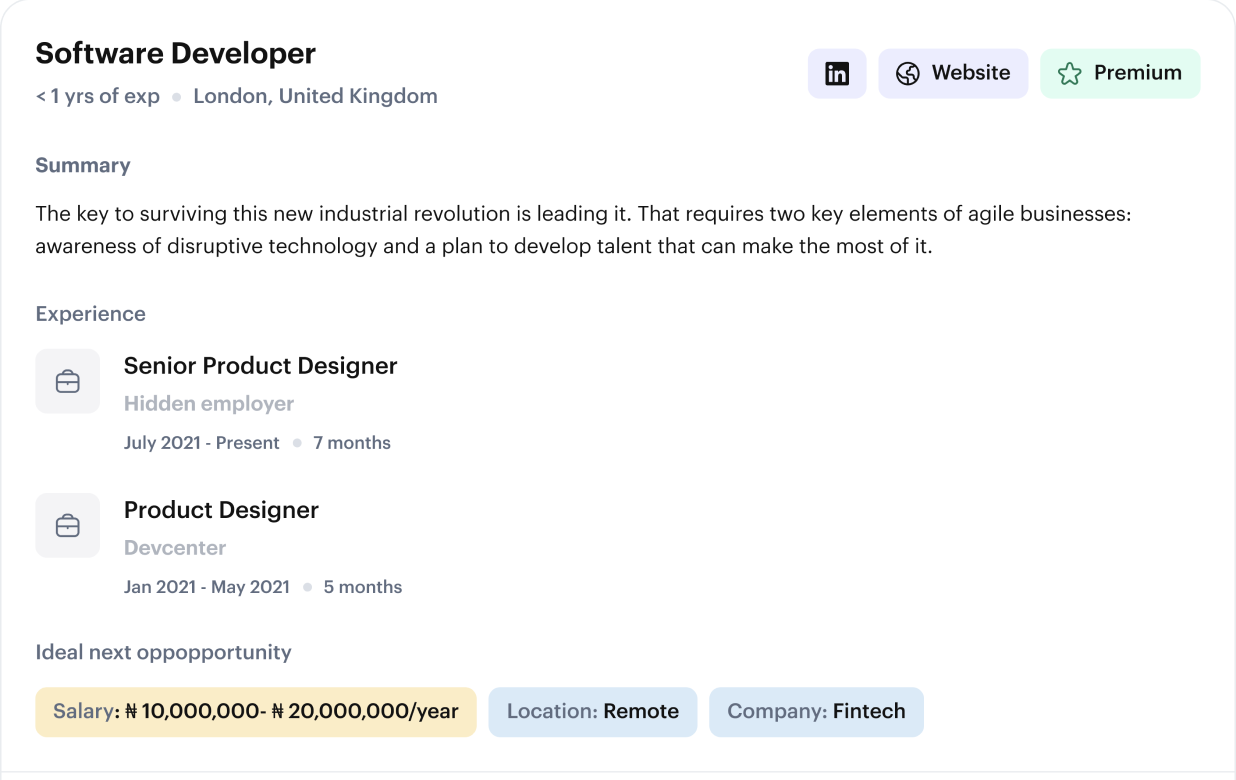

Hire the Best on Gigson

Through Gigson, we curate a pool of exceptional software developers who meet your specific project needs. Our recommendation analyzes skills, experience, and expertise, ensuring that you get matched with the right talent seamlessly. With Gigson, connecting with top tech talents becomes a seamless process. Take charge of your hiring process, access personalized top-tech talents, and build a team that aligns with your vision. Start here.

FAQs

1. Given the emphasis on market potential and growth trajectory, how do African tech startups effectively demonstrate their understanding of market dynamics and articulate a sustainable growth strategy to attract investors?

Ans: African tech startups can effectively demonstrate their understanding of market dynamics and articulate a sustainable growth strategy by conducting thorough market research to identify untapped opportunities and potential challenges. By presenting data-driven insights into market trends, consumer behaviors, and competitive landscapes, startups can showcase their market potential and growth trajectory to investors. Additionally, they can develop a comprehensive business plan that outlines their strategic approach to capturing market share, expanding their customer base, and achieving long-term sustainability, thereby instilling confidence in investors regarding the startup's viability and scalability.

2. While experienced and committed teams are crucial for securing funding, what strategies can early-stage startups employ to overcome challenges related to talent acquisition and retention, especially in competitive markets with limited resources?

Ans: Early-stage startups can employ several strategies to overcome challenges related to talent acquisition and retention in competitive markets with limited resources. Firstly, they can leverage their networks and establish partnerships with educational institutions, industry associations, and professional networks to access a diverse pool of talent. Offering competitive compensation packages, including equity options and performance-based incentives, can also help attract and retain skilled professionals. Moreover, startups can create a positive work culture that values innovation, collaboration, and continuous learning, thereby fostering employee engagement and loyalty. Additionally, providing opportunities for career development, mentorship, and autonomy can enhance job satisfaction and reduce turnover rates, ultimately strengthening the startup's ability to build and retain a talented team.

3. With the success stories highlighted in the article, what specific challenges or barriers do African tech startups encounter during the funding process, and how can they navigate these obstacles to increase their chances of securing investment in 2024?

Ans: Despite the success stories highlighted in the article, African tech startups may encounter various challenges during the funding process, including limited access to capital, regulatory hurdles, and market uncertainties. To navigate these obstacles and increase their chances of securing investment in 2024, startups can focus on building strong relationships with investors through effective communication, transparency, and trust-building initiatives. They can also diversify their funding sources by exploring alternative financing options such as government grants, angel investors, and crowdfunding platforms. Additionally, startups should prioritize building a scalable and sustainable business model, demonstrating clear revenue streams, and showcasing their ability to achieve significant market traction and user engagement. By addressing these challenges proactively and leveraging available resources, African tech startups can position themselves for successful funding rounds in 2024.

Request a call back

Lets connect you to qualified tech talents that deliver on your business objectives.