Raising Capital Beyond VC Funding

Building and scaling a startup in a constantly changing economic situation demands resilience, adaptability, and strategic thinking.

Here's an in-depth look at both non-dilutive and dilutive funding options that can steer your startup toward success:

Non-dilutive Funding Options:

1. Accelerators: These programs offer more than just funding; they provide mentorship, resources, and a supportive ecosystem. In return, startups often exchange equity, but the value of the accelerator program extends beyond capital.

2. Government Grants: Explore the various initiatives rolled out by governmental bodies to foster innovation and sustainable growth. These grants can provide starting capital without seeking equity.

3. Crowdfunding (non-equity): Platforms like Kickstarter or Indiegogo empower startups to engage with a broad audience. Supporters contribute funds in exchange for non-financial rewards, making it a non-dilutive and community-driven approach.

4. Bank Loans (Ethical Banks): Most banks consider environmental and social factors alongside financial viability when evaluating loan applications. This option aligns with startups committed to sustainable and socially responsible practices.

5. Revenue Based Financing: In this model, startups secure funding by pledging a percentage of their future revenue. It offers flexibility and aligns repayment terms with the startup's financial performance, avoiding equity dilution.

6. Venture Debt: Tailored for startups, venture debt provides access to specialized debt without the need for equity dilution. It's particularly valuable for bridging financing gaps and funding capital-intensive activities.

Dilutive Funding Options:

1. Angels (Syndicates and Networks): Business angels, either as individuals or groups, contribute capital and expertise in exchange for equity. Their involvement often goes beyond financial support, they provide valuable guidance to early-stage ventures.

2. Equity Crowdfunding: Startups can offer equity to a large pool of investors through dedicated platforms. This approach allows a broader audience to become shareholders and supporters of the startup.

3. Venture Builders: These entities, also known as startup studios, provide a unique form of support. Beyond capital injection, venture builders offer extensive support, resources, and expertise to early-stage startups, helping in their development.

4. Corporate Venture Capital (CVC): Established companies invest in external startups that align with their strategic objectives. Startups benefit not only financial support but also access to networks, industry expertise, and potential market opportunities.

When navigating funding, startups often employ a combination of these avenues based on their specific needs and growth stage. Whether you’re opting for non-dilutive sources to maintain ownership or embracing dilutive options for strategic partnerships, each funding avenue contributes to the unique journey of every startup.

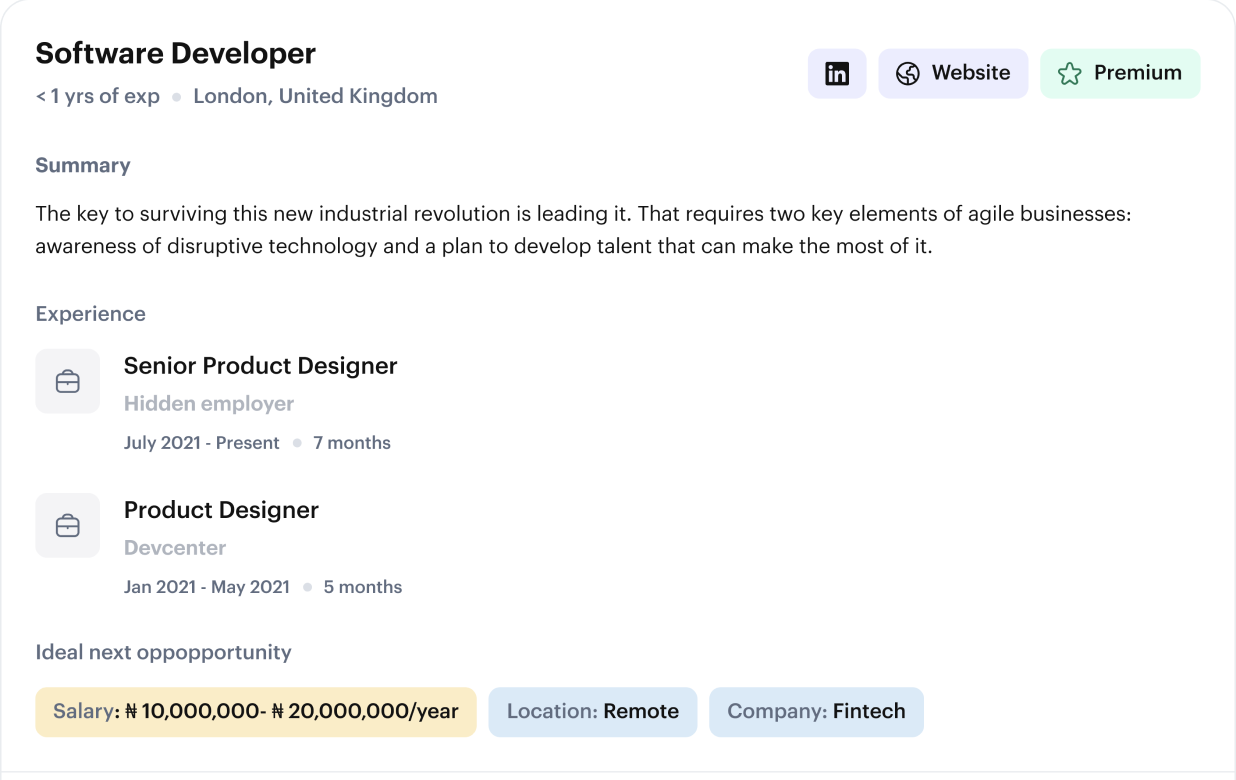

Hire the Best on Gigson Recommend

Exploring these alternative funding options may necessitate specialized tech solutions, and that's where Gigson comes in. Our developers are ready to collaborate with you in building and ensuring your startup stands out in the funding process. With Gigson, connecting with top tech talents becomes a seamless process. Take charge of your hiring process, access personalized top-tech talents, and build a team that aligns with your vision. Start here.

FAQs

1. How do startups effectively determine which combination of non-dilutive and dilutive funding options is most suitable for their specific growth stage and objectives?

Ans: Startups can effectively determine the most suitable combination of non-dilutive and dilutive funding options by carefully assessing their growth stage, financial needs, and strategic objectives. They can consider factors such as the amount of capital required, the urgency of funding, the impact on ownership and control, and the availability of resources beyond capital. Additionally, startups can seek guidance from experienced advisors, mentors, or industry experts who can provide insights tailored to their specific circumstances.

2. What are the potential challenges and considerations involved in accessing non-dilutive funding sources such as government grants or revenue-based financing, and how can startups navigate them successfully?

Ans: Accessing non-dilutive funding sources such as government grants or revenue-based financing may involve potential challenges such as stringent eligibility criteria, lengthy application processes, and competition from other startups. Startups can navigate these challenges successfully by thoroughly researching available funding opportunities, ensuring compliance with application requirements, preparing compelling proposals or business plans, and demonstrating alignment with the objectives of the funding source. Additionally, startups can leverage professional networks, seek assistance from consultants or grant writers, and actively engage with relevant government agencies or funding organizations to increase their chances of securing non-dilutive funding.

3. Can startups leverage both non-dilutive and dilutive funding options simultaneously, and if so, what strategies can they employ to balance the benefits and drawbacks of each type of funding while maintaining their overall financial health and ownership structure?

Ans: Yes, startups can leverage both non-dilutive and dilutive funding options simultaneously to meet their financial needs while maintaining a balanced ownership structure and financial health. To do so, startups can develop a comprehensive funding strategy that integrates various sources of capital based on their short-term and long-term goals. For example, startups may use non-dilutive funding to finance specific projects or initiatives while utilizing dilutive funding to support overall growth and expansion. By carefully managing the trade-offs and synergies between different funding sources, startups can optimize their funding mix and maximize their chances of success.

Request a call back

Lets connect you to qualified tech talents that deliver on your business objectives.