African Startups Guide to Managing Salary Expectations with Inflation

What steps do you take when the economy is not in your favor as a startup founder and your financial investments are increasing? How do you balance this with expectations from employees and customers?

Navigating salary expectations amidst inflation is a very important discussion when managing a startup in Africa. For example, In Nigeria, the inflation rate in December 2023 had increased to 28.92% from May 2023's 23.65%, as reported by the Central Bank of Nigeria. While battling inflation, early-stage funding remains a challenge for tech startups, prompting entrepreneurs to seek alternative sources like government initiatives, grants, angel investors, and venture capital firms. However, these options often come with drawbacks such as high-interest rates, strict requirements, and/or delayed disbursements. Foreign investment is also hard to attract due to currency fluctuations, political instability, and policy uncertainty.

Startups must adopt strategies to ensure fair compensation for employees while maintaining financial sustainability. Here are free tips to help African startups better manage salary expectations during inflation:

1. Transparent Communication:

Open and transparent communication is very important. Communicate with your team about the impact of inflation on the overall economy and, consequently, on the company's financials. Being transparent helps employees understand the need for adjustments when they are made.

2. Regular Salary Reviews:

Implement a regular salary review process. In periods of inflation, conducting more frequent reviews allows you to make gradual adjustments, which can be more manageable for both the company and employees.

3. Performance-Based Compensation:

Tie a portion of compensation to performance. Implement performance-based incentives to allow employees to actively contribute to the company's success, and align their interests with the company's growth. This can be a strategic way to manage compensation costs.

4. Flexible Benefits:

Offer flexible benefits and perks that can enhance the overall compensation package without significantly affecting the fixed salary. This might include wellness programs, additional vacation days, or professional development opportunities.

5. Inflation Indexing:

Consider indexing salaries to inflation. Inflation indexing is an automatic cost-of-living adjustment built into tax provisions to keep up with inflation. This ensures that salaries automatically adjust based on the inflation rate, providing a systematic and fair approach to managing economic changes.

6. Employee Education:

Educate your employees on financial literacy. Help them understand the impact of inflation on their purchasing power and provide guidance on managing personal finances during inflationary periods.

7. Benchmarking Against Industry Standards:

Regularly benchmark your salary structure against industry standards. By comparing your company's performance to that of similar companies in the same industry. This ensures that your compensation remains competitive, and helps you attract and retain top talent.

8. Employee Assistance Programs:

Anticipate potential economic changes. Have contingency plans and consider implementing employee assistance programs that provide support beyond financial compensation. This can include mental health services, counselling, or other resources to help employees navigate challenging economic times.

By trying these strategies, African startups can proactively manage and navigate the complexities of salary expectations during inflation and ensure long-term growth.

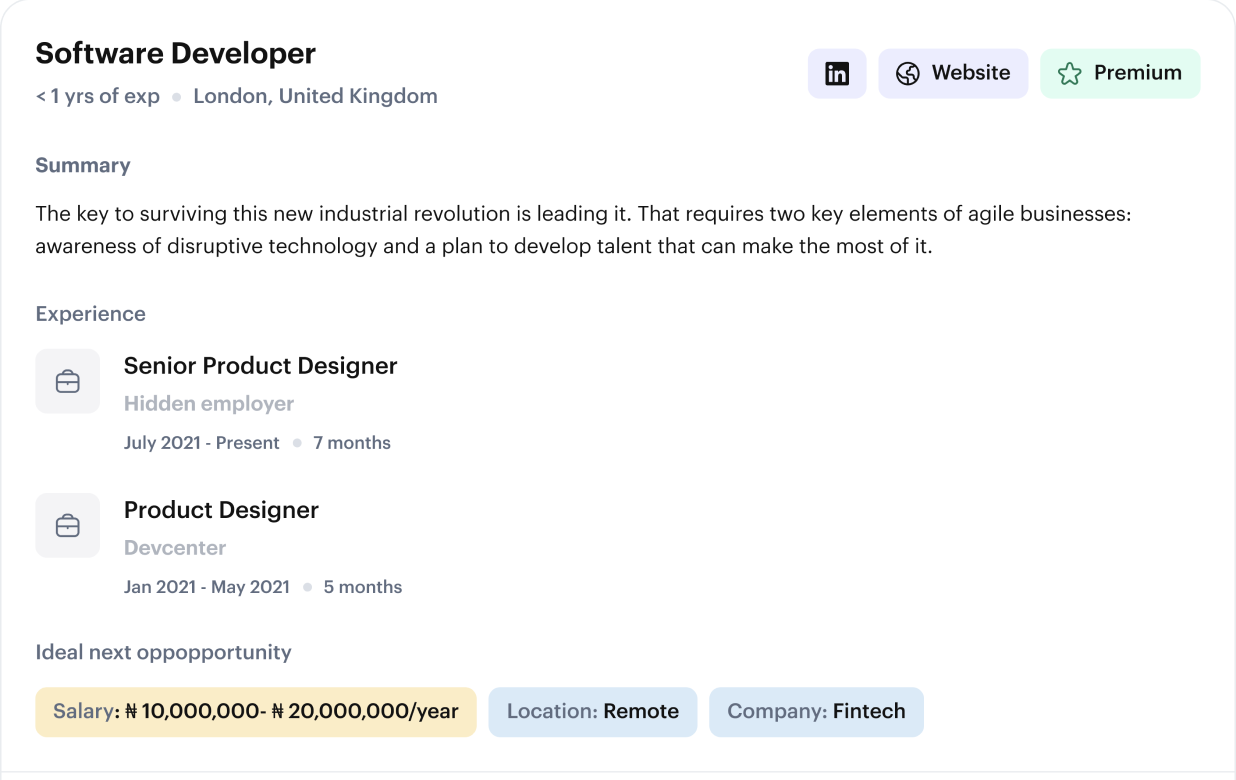

Budget-Friendly Tech Talent Hiring

Gigson Recommend is a platform that can be used to hire software developers without a significant financial investment, making the technical aspect of the business easier to manage. Our recommendation analyzes skills, experience, and expertise, ensuring that you get matched with the right talent seamlessly. With Gigson Recommend, connecting with top tech talents becomes less stressful. Take charge of your hiring process, access personalized top-tech talents, and build a team that aligns with your vision. Start here.

FAQs

1. Given the challenges of inflation and funding for startups in Africa, what specific strategies can founders employ to attract and retain top talent amidst economic uncertainties?

Ans: In managing salary expectations amidst economic uncertainties like inflation and funding challenges, African startup founders can leverage various strategies. These may include implementing flexible compensation structures, such as performance-based incentives, and offering non-monetary benefits to enhance the overall employee value proposition. Additionally, startups can explore alternative funding sources like government initiatives, grants, angel investors, and venture capital firms to ensure adequate financial resources for fair compensation.

2. How do startups in Africa navigate the complexities of salary adjustments during periods of high inflation while still maintaining financial sustainability and growth prospects?

Ans: Navigating the complexities of salary adjustments during periods of high inflation requires a delicate balance between maintaining financial sustainability and meeting employee expectations. Startup founders in Africa can achieve this balance by adopting transparent communication practices to explain the impact of inflation on the company's financials. They can also conduct regular salary reviews to make gradual adjustments aligned with economic changes while considering performance-based compensation models to manage costs effectively.

3. In addition to the strategies mentioned, what other innovative approaches or best practices can startups adopt to manage employee salary expectations effectively in the face of inflationary pressures?

Ans: Beyond the strategies mentioned in the article, African startups can explore innovative approaches to manage employee salary expectations during inflationary periods. For example, they can implement inflation indexing to automatically adjust salaries based on the inflation rate, ensuring fairness and consistency. Additionally, startups can invest in employee education on financial literacy to empower staff to navigate personal finances effectively amidst economic fluctuations. Moreover, benchmarking against industry standards and offering employee assistance programs can further support startups in attracting and retaining top talent while fostering long-term growth and stability.

Request a call back

Lets connect you to qualified tech talents that deliver on your business objectives.